Strategies at Various Levels of Management: Building Blocks of Organizational Success

Introduction: The Backbone of Every Winning Organization

In today’s dynamic business landscape, a company’s success hinges on more than great products or innovative technologies—it requires a well-crafted strategy at every tier of management. Effective strategy acts as a compass, guiding the organization from abstract vision to concrete results. In this comprehensive guide, we’ll explore the different layers of strategy within organizations—corporate, business, and functional levels—and unpack the various types of strategies organizations utilize to achieve their objectives, stay resilient, and foster long-term growth.

Table of Contents

- nderstanding Strategic Management Levels

- Corporate Strategy: Steering the Organization’s Direction

- Business Strategy: Competing at the Market Level

- Functional Strategy: The Power of Everyday Decisions

- Types of Major Strategies

- Corporate Strategies

- Concentration Strategies

- Integration Strategies

- Diversification Strategies

- Retrenchment Strategies

- Conclusion: Integrating Strategy for Sustainable Success

- Key Takeaways & FAQ

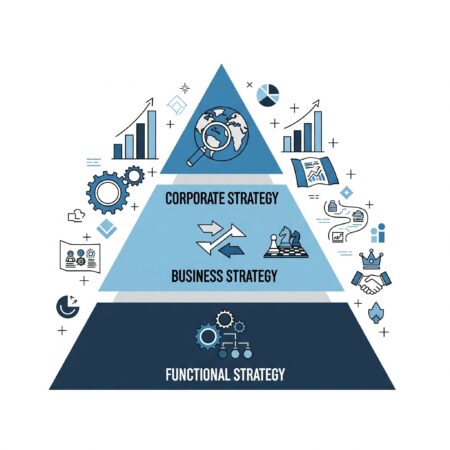

1. Understanding Strategic Management Levels

Strategy isn’t a one-size-fits-all concept. It cascades down the organization, adapting to the scope and needs at each level:

- Corporate Strategy: Sets the overarching vision and direction.

- Business Strategy: Focuses on how each business unit will compete and succeed.

- Functional Strategy: Directs daily operations and functional excellence at the ground level.

Let’s dive into what each means for a modern enterprise.

2. Corporate Strategy: Steering the Organization’s Direction

Corporate strategy is the guiding star for the whole organization. Crafted by the CEO and top leaders, this is where vision, purpose, and ambition come together. These strategies set a broad, future-oriented framework—typically spanning three to five years—for achieving the organization’s long-term objectives.

Core Elements of Corporate Strategy

- Vision: Where the company aspires to be

- Values: Principles that shape culture and behavior

- Strategic Focus Areas: The main pillars for resource allocation and executive attention

- Objectives: Measurable targets and milestones

- KPIs: Key Performance Indicators to track progress

Corporate strategies are big-picture, conceptual, and forward-thinking, guiding all subsequent strategies within the company.

Examples:

- Apple Inc.: Focuses on innovation, user experience, and market leadership in technology.

- Google: Champions the motto “Don’t be evil,” invests in search and advertising technologies, and strategically expands its global reach.

3. Business Strategy: Competing at the Market Level

A business-level strategy answers: “How will each unit compete and win in its chosen market?” This tier is critical for diversified organizations with multiple divisions, brands, or product lines.

Who develops business strategies?

- Heads of business units and middle managers

- Involvement of multiple managers boosts buy-in and ownership, increasing the likelihood of success.

Examples:

- Starbucks: Diversifies offerings beyond coffee (food, merchandise, digital services), tailoring experiences to local markets.

- Amazon: Expands into distinct segments—e-commerce, AWS (cloud computing), Prime Video—each with tailored strategies for innovation and growth.

4. Functional Strategy: The Power of Everyday Decisions

Functional or operational strategy sits at the frontlines—marketing, finance, human resources, production, and more. It’s about translating higher-level strategies into tactical objectives for each function and guiding daily activity. Alignment at this level drives execution, operational improvement, and sustained excellence.

Example:

- Toyota: Embraces lean manufacturing, continuous improvement (kaizen), and quality control to maximize efficiency and product quality.

5. Types of Major Strategies

Organizations don’t rely on a single strategic approach—they select, mix, or pivot among different types based on their goals, context, and challenges.

5.1 Corporate Strategies

Stability Strategy

- When used: The company is satisfied with its position and aims for steady revenue and efficiency improvements.

- Examples:

- Steel Authority of India: Focuses on operational efficiency over expanding capacity.

- McDonald’s: Maintains a core menu, introducing limited-time promotions to retain customer interest.

Expansion Strategy

- When used: The company seeks growth—new markets, new products, or international expansion.

- Examples:

- A restaurant/franchise adds new outlets in other cities/countries.

- Apple: Enters new segments (wearables, digital services) and expands its ecosystem.

Retrenchment Strategy

- When used: The company needs to cut costs, focus efforts, or withdraw from unprofitable sectors (often in downturns or crises).

- Examples:

- Mahindra & Mahindra: Sold the M-Seal brand to consolidate operations.

- GE: Divested non-core divisions like appliances to focus on aviation/healthcare.

Combination Strategy

- When used: The company uses a blend of stability, expansion, and retrenchment—tailored to each product, market, or unit.

- Examples:

- Reliance Industries: Started in textiles, shifted into retail and petrochemicals to address distribution inefficiencies.

- Procter & Gamble: Maintains stable brands while expanding into new product categories.

5.2 Concentration Strategy

Focuses resources on a narrow target, such as a group of customers, a single product, or a specific region—enhancing expertise and competitive edge.

Examples:

- McDonald’s, Starbucks, Subway: Dominate fast food and coffee shop markets with focused menus and standardized processes.

- Nike: Leads in athletic wear by narrowing its focus to sports apparel and footwear.

Substrate breakdown:

- Market Penetration: Growing market share for current products via marketing (e.g., Samsung’s smartphone blitz).

- Market Development: Selling existing products in new markets (e.g., Amazon expanding into new countries/regions).

- Product Development: Launching new products for current customers (e.g., Apple’s regular updates to iPhones and Macs).

5.3 Integration Strategy

Refers to expanding a company’s scope by controlling more of the supply chain (vertical) or absorbing competitors (horizontal).

Vertical Integration

- Backward Integration: Owns suppliers (e.g., Apple designing its own chips).

- Forward Integration: Controls distribution/retail (e.g., Apple Stores).

- Balanced Integration: Performs both.

Example:

- ExxonMobil: Manages everything from oil exploration to refining and retail.

Horizontal Integration

- Goal: Absorb direct competitors to grow market share.

- Examples:

- Facebook (Meta): Acquired Instagram to increase its footprint in social media.

- Disney: Bought Pixar and Marvel for entertainment dominance.

5.4 Diversification Strategy

Seeks growth by entering new markets or industries, often through internal development, mergers, acquisitions, or partnerships.

Types of Diversification

- Concentric Diversification: New line closely related to existing core (e.g., Coca-Cola launching bottled water).

- Horizontal Diversification: New, related products for existing customers (e.g., Tata Group venturing into aviation, Samsung adding home appliances).

- Conglomerate Diversification: Adds unrelated businesses to capitalize on brand or resources (e.g., Berkshire Hathaway investing in insurance, energy, and retail).

Examples:

- General Electric: Moved from electronics to aviation, energy, finance, and more.

- Alphabet: Broad investments beyond Google—AI, autonomous vehicles, biosciences.

5.5 Retrenchment Strategy

Used to streamline operations or address crises by scaling back, restructuring, or exiting certain businesses.

Types of Retrenchment

- Liquidation: Complete closure and asset sale (e.g., Borders bookstore chain’s shutdown).

- Turnaround: Revives underperforming units with new leadership/strategy (e.g., Ford restructuring to regain profitability).

- Divestment: Sells non-strategic businesses to focus on core strengths (e.g., General Motors selling European units; IBM focusing on cloud/AI).

6. Conclusion: Integrating Strategy for Sustainable Success

An organization’s ability to thrive, adapt, and lead hinges on a clear alignment of corporate, business, and functional strategies—supported by careful selection of overall corporate maneuvers like expansion, concentration, integration, diversification, and retrenchment. The companies that prosper over decades are those who continuously refine their strategies at every level, turning vision into action and risk into opportunity.

Whether you’re a startup owner, a business unit leader, or a member of top management, understanding and applying strategies at every level is essential to driving your organization toward lasting success

7. Key Takeaways & FAQ

Key Points:

- Strategy must align from the corporate level down to daily operations.

- The right mix of strategies (stability, expansion, retrenchment, etc.) depends on context and objectives.

- Involvement at all management levels increases buy-in and execution success.

- Examples from leading companies showcase how strategies operate in real life.

Frequently Asked Questions:

Q: Why are different levels of strategy important?

A: They ensure every part of the business—from the boardroom to the shop floor—is working toward the same broad vision, with tactics suited to their unique challenges.

Q: What happens if strategies at different levels are misaligned?

A: Operational confusion, wasted resources, and missed objectives. Alignment ensures efficiency and effectiveness.

Q: How can a business choose the right strategy?

A: By thoroughly analyzing its environment, resources, vision, and risk tolerance, and by learning from both successes and failures.

Ready to Elevate Your Strategy?

Stay tuned for more insights in our series—or reach out to our team for tailored advice on crafting and executing winning strategies at every level of your organization!

Author of the Article above